Halifax, NS, February 13, 2017 – DHX Media Ltd. (or the “Company”) (TSX: DHX.A, DHX.B; NASDAQ: DHXM), the world’s leading independent, pure-play children’s content company, reports its second quarter results for Fiscal 2017, ended December 31, 2016.

“We continue to deliver on our strategic priorities of creating engaging kids’ content that sells globally, and driving sales growth in our branded consumer products business,” said Dana Landry, CEO of DHX Media. “We are seeing strong demand for our kids’ titles across all media platforms, as well as new opportunities to unlock incremental value in our library. Q2 revenue from our core proprietary content business was up 10% from a year ago, and we’re achieving double-digit growth in our WildBrain online kids’ network. We believe an equally significant opportunity lies ahead for consumers to click and buy their favourite characters while viewing our content.”

1 As a direct result of the adoption of the amendment to IAS 38, the Company’s definitions of Gross Margin and Adjusted EBITDA have been adjusted on a prospective basis. Gross Margin means revenue less direct production costs and expense of film and television programs produced (per the financial statements). Adjusted EBITDA represents income of the Company before amortization, finance income (expense), taxes, development expenses, impairments, share-based compensation expense, and adjustments for other identified charges. (The definitions of and changes to the definitions of Gross Margin and Adjusted EBITDA are included in the “Use of Non-GAAP Financial Measures” section of the Company’s Q2 2017 Management Discussion and Analysis).

Highlights included:

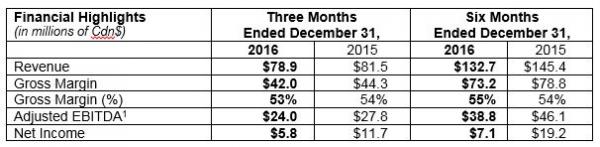

- Q2 2017 revenue of $78.9 million, down 3% compared to Q2 2016, due largely to expected declines in quarterly targets, was at the top-end of Management’s expectations.

- At quarter-end, we had invested $31.4 million in ongoing proprietary production, resulting in a robust pipeline with the majority of these productions expected to be delivered in the remainder of Fiscal 2017 and into early Fiscal 2018.

- We continued to benefit from the strong appetite for original kids’ content around the world to drive growth in our proprietary content business. This has resulted in a 10% increase in revenue to $48.4 million from our proprietary content derived from production, distribution and consumer products-owned as an integrated group compared with Q2 2016.

- Our expanded focus on new growth through ad-based video-on-demand (AVOD) is also bearing excellent results, as evidenced by a 78% rise in WildBrain revenue to $9.4 million over Q2 2016.

- Adjusted EBITDA of $24.0 million was in line with Management’s expectation for Q2 2017 while net income of $5.8 million was impacted by a foreign exchange loss versus a significant foreign exchange gain in Q2 2016.

- DHX Media continued to focus and execute on its strategic priorities of: (i) expanding its content library; (ii) distributing its shows worldwide; and (iii) developing global brands with strong consumer product potential.

- Our library now sits at more than 12,500 half-hours, and we continue to invest in content at a time when consumption of kids’ content is booming. In Q2 2017, 53 half-hours of proprietary titles were added to the library for a total of 88 half-hours in Fiscal 2017 YTD.

- The scale of our library makes DHX Media a veritable “one stop shop” for leading streaming platforms as they expand globally. Today we announced the signing of another large content deal with Amazon Prime Video, which sees the SVOD provider picking up more than three dozen of our shows for its new service in India.

- Through our WildBrain network, we are further monetizing our library on YouTube, which positions us well to benefit from the rising trend in ad-based video-on-demand (AVOD). Recent partnerships with Turner Kids International for Europe, the Middle East and Africa (EMEA) plus Latin America, and with Moose Toys highlight the value that third-party brand and content owners see in leveraging our digital expertise and market-leading online kids’ network to extend their global reach, which we expect to contribute to WildBrain’s growth.

- Nickelodeon has signed on as the exclusive broadcaster in the U.S. for season two of the new Teletubbies, which points to the enduring appeal of our flagship brand, just as a new toy program is rolling out in the U.S. U.K. toy sales of Teletubbies showed continued strength, and were a top-seller this Christmas for master toy licensee, Character Options.

- DHX Media’s track record for global brand development was recognized with its licensing agency, CPLG, recently named to represent Mattel in Eastern Europe on key brands including Thomas & Friends, Fireman Sam and Bob the Builder.

Dividend Declaration

Today, the Company declared a dividend for the quarter of $0.019, an increase of 6%, on each common voting share and variable voting share outstanding to the shareholders of record at the close of business on February 24, 2017 to be paid on March 17, 2017.

Outlook

Management has updated its annual guidance for the second half of Fiscal 2017. Details of management’s expectations for revenues, gross margins and operating expenses for Fiscal 2017 can be found in the Outlook section of the Company’s Q2 2017 MD&A, available at www.dhxmedia.com, on www.sedar.com or http://www.sec.gov/edgar.

Analyst call detail

DHX Media will hold a conference call for analysts and investors to discuss its Fiscal Q2 2017 results on Monday, February 13, 2017 at 9 a.m. ET. Media are welcome to listen in.

Interested parties may listen to the live audio webcast at: http://edge.media-server.com/m/p/x9ym4nev.

To listen by phone, please call +1(844) 492-6042 toll-free or +1(478) 219-0838 internationally and reference conference ID 66536767. Please allow 10 minutes to be connected to the conference call. Instant replay will be available after the call on +1(855) 859-2056 toll free, or +1(404) 537-3406, under passcode 66536767, until 11:59 p.m. ET, February 15, 2017.

Q2 2017 Results

Revenues

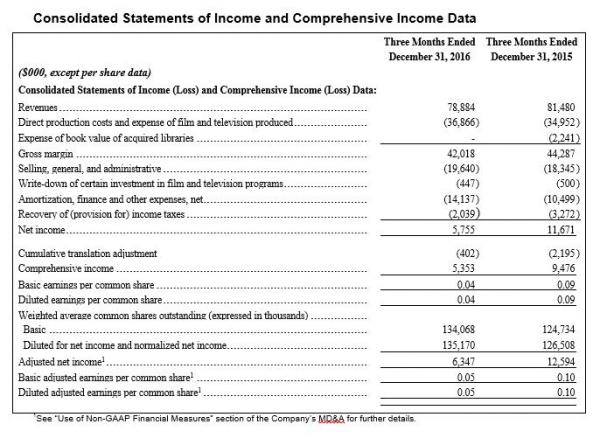

Revenues for Q2 2017 were $78.88 million, down 3% from $81.49 million for Q2 2016. In absolute dollars, the decrease in Q2 2017 was due largely to expected declines and quarterly targets in DHX Television, consumer products-represented revenues, proprietary production and producer and service fees, offset by increases in distribution and consumer products-owned. Comparatively, Q2 2017 and Q2 2016 include the same assets in terms of prior acquisitions; accordingly, all revenue fluctuations in comparing Q2 2017 to Q2 2016 are organic. A detailed review of each source of revenue is included below.

Proprietary content revenues: The Company’s proprietary content revenue for Q2 2017 was up 10% to $48.42 million from $44.09 million for Q2 2016. Management is pleased that its strategic priority of investment in content is materializing.

Proprietary production revenues: Proprietary production revenues for Q2 2017 were $17.68 million, a decrease of 15% compared to $20.71 million for Q2 2016. For Q2 2017, the Company added 53.0 proprietary half-hours to the library down 30% versus 76.0 proprietary half-hours for Q2 2016. For Q2 2017, the Company added 23.0 half-hours of third party produced titles with distribution rights (Q2 2016 – 16.0 half-hours), an increase of 44%, and an example of the operational synergies associated with owning DHX Television. Management was pleased as the proprietary production revenue was near the top-end of previously reported quarterly expectations.

Distribution and WildBrain revenues: Total distribution revenues were up 21% to $22.41 million, from $18.58 million for Q2 2016, driven by very strong growth in WildBrain. For Q2 2017, distribution revenues excluding WildBrain were generally in line with the previous year’s quarter at $12.97 million, down slightly by $0.32 million (Q2 2016-$13.29 million), as the Company experienced consistent demand for content from competing SVOD and other players. For Q2 2017, amongst other key distribution deals for both linear and digital platforms, the Company closed significant deals with AMC Networks, iQiyi, Huashi, Shomax BV, Super RTL, and VMe TV. Management is very pleased to report that revenues from WildBrain were $9.44 million for Q2 2017, reflecting 78% growth versus Q2 2016 revenues of $5.29 million. Distribution revenues excluding WildBrain were at the top-end of the Management’s previously reported quarterly expectations.

Consumer products-owned revenues (formerly M&L-owned) (including music and royalties): For Q2 2017, the consumer products-owned revenues were $7.89 million, up 82% as compared to $4.34 million for Q2 2016. For Q2 2017, consumer products-owned revenues included $3.90 million from the international portion of The Next Step Wild Rhythm tour, compared to Q2 2016, when the Company had no live tour revenue. Excluding the live tour revenues, consumer products-owned revenues for Q2 2017 were $3.99 million compared to $4.34 million for Q2 2016, an increase of 8%, as the Company continued to recognize revenues related to non-refundable minimum guarantees associated with Teletubbies, In The Night Garden, and Twirlywoos. Management expects consumer products-owned revenues from Teletubbies to continue to ramp up in late Fiscal 2017 and into Fiscal 2018 as Teletubbies toys are rolled out in the US and other markets. Consumer products-owned revenues were well above the high-end of Management’s quarterly expectations, generally driven by higher than expected live tour revenues. This did, however, create some margin pressure as live tour revenues have materially lower gross margins than royalty based consumer products revenue.

Producer and service fee revenues: For Q2 2017, the Company earned $10.42 million of producer and service fee revenues, a decrease of 9% versus the $11.49 million from Q2 2016, which were at the lower-end of Management’s previously reported quarterly expectations. Management expects progress to accelerate for the remainder of Fiscal 2017 on a number of key service projects.

New media revenues: For Q2 2017, new media revenues were down $0.01 million or 3% to $0.45 million (Q2 2016-$0.46 million) based primarily on apps and games.

Television revenues: For Q2 2017, DHX Television revenues were down 18% to $15.39 million from $18.78 million from Q2 2016, and were near the low-end of Management’s quarterly expectations. The decline in the subscriber revenues was expected and has been driven by the negotiated lower rates resulting from the Company’s strategic decision to focus the majority of the TV slate on our own proprietary content. The decline was also driven by lower than expected promotion and advertising revenue as the Company has just been begun to step up its efforts in this regard after recently getting approval from the CRTC to allow broadcast advertising for the Family Channel. Approximately 88% or $13.53 million of the television revenues were subscriber revenues, while advertising, promotion, and digital revenues accounted for a combined 12% or $1.87 million of the total television revenues.

Consumer products-represented revenues (formerly M&L-represented): For Q2 2017, consumer products-represented revenues were, as expected, down $2.48 million, or 35%, to $4.64 million compared to Q2 2016 at $7.12 million, however were at the top-end of Management’s previously reported quarterly expectations. Consumer products-represented revenues were driven mainly by the continued strong performance of our represented brands Despicable Me and Minions, Sesame Street, Dora the Explorer, The Pink Panther, and Jurassic World. The Q2 2016 results benefited significantly from the 2016 holiday season strength of Despicable Me and Minions brands.

Gross Margin

As previously noted herein and as a result of the adoption of the amendment to IAS 38, the Company has adjusted its definition of gross margin, the details of which are included in the “Use of Non-GAAP Financial Measures” section of the MD&A. The Company expects, amongst other potential impacts, the adoption of the amendment to IAS 38 will result in increased fluctuations in the percentage gross margins from period to period. Overall, Management expects the adoption of the amendments to IAS 38 to have a positive impact on overall gross margins. As a result of the adoption of the amendment to IAS 38, the Company will now group proprietary production, distribution (including WildBrain), consumer products-owned, and new media & other into a single Proprietary Content Gross Margin for the purpose of providing analysis of gross margins. The change has been applied prospectively.

Gross margin for Q2 2017 was $42.02 million, a decrease in absolute dollars of $2.27 million or 5% compared to $44.29 million for Q2 2016. The overall gross margin for Q2 2017 at 53% of revenue was near the mid-point of Management’s revised previously reported quarterly expectations. At 49%, proprietary content margins were near the mid-point of Management’s expectations and slightly lower than other quarters, driven by seasonally high proprietary production deliveries, which trigger higher production cost amortization, and higher than expected live tour revenues, which carry lower gross margins. At 40%, gross margins for producer and service fees were near the mid-point of Management’s expectations. Gross margins for DHX Television, at 61%, were well within Management’s expectations, impacted by both lower external content costs and lower revenues when compared to Q2 2016. Gross margin for Q2 2017, including DHX Television, was calculated as revenues of $78.88 million, less direct production costs and expense of investment in film & television programs of $36.87 million and $nil expense of book value of acquired libraries, (Q2 2016-$81.48 million less $34.95 million and less $2.24 million, respectively).

For Q2 2017, the margins for each revenue category in absolute dollars and as a margin percentage were as follows: the proprietary content business had a gross margin of $23.76 million or 49%, net producer and service fee revenue margin of $4.18 million or 40%, television margin was $9.44 million or 61%, and consumer products-represented revenue margin was $4.64 million or 100%.

Operating Expenses (Income)

SG&A

SG&A costs for Q2 2017 increased 7% to $19.64 million compared to $18.35 million for Q2 2016. SG&A includes $1.60 million (Q2 2016-$1.82 million) in non-cash share-based compensation. When adjusted, cash SG&A at $18.04 million was at the high-end of Management’s previously reported quarterly expectations, driven by both increased SG&A costs at WildBrain and increased corporate development activities as Management continues to pursue acquisition opportunities.

Adjusted EBITDA

For Q2 2017, Adjusted EBITDA was $23.98 million, down $3.78 million or 14% over $27.76 million for Q2 2016. Please see the “Use of Non-GAAP Financial Measures” and “Reconciliation of Historical Results to Adjusted EBITDA” sections of this MD&A for the definition and detailed calculation of Adjusted EBITDA.

About DHX Media

DHX Media Ltd. (www.dhxmedia.com) is the world’s leading independent, pure-play children’s content company. Owner of the world’s largest independent library of children’s content, at more than 12,500 half-hours, the company is recognized globally for such brands as Teletubbies, Yo Gabba Gabba!, Caillou, In the Night Garden, Inspector Gadget, Make It Pop, Slugterra and the multiple award-winning Degrassi franchise. As a content producer and owner of intellectual property, DHX Media delivers shows that children love, licensing its content to major broadcasters and streaming services worldwide. Through its subsidiary, WildBrain, DHX Media also operates one of the largest network of children’s content on YouTube. The company’s robust consumer products program generates royalties from merchandise based on its much-loved children’s brands. Headquartered in Canada, DHX Media has offices in 15 cities globally, and is listed on the Toronto Stock Exchange (DHX.A and DHX.B) and the NASDAQ Global Select Market (DHXM).

Disclaimer

This press release contains “forward looking statements” under applicable securities laws with respect to DHX Media including, but not limited to, statements regarding the effect of the adoption of the amendment to IAS 38 on gross margins and Adjusted EBITDA of the Company, the timing of production schedules and deliveries, opportunities associated with consumer purchases through content, the markets and industries in which the Company operates, including demand for and consumption of kids’ content, the business strategies and operational activities of DHX Media and its subsidiaries, and the growth and financial and operating performance of DHX Media, its subsidiaries, and investments. Although the Company believes that the expectations reflected in such forward looking statements are reasonable, such statements involve risks and uncertainties and are based on information currently available to the Company. Actual results or events may differ materially from those expressed or implied by such forward looking statements. Factors that could cause actual results or events to differ materially from current expectations, among other things, include delivery and scheduling risk associated with production revenues, the Company’s ability to execute and close anticipated licensing transactions, the Company’s ability to identify, negotiate and execute on acquisition opportunities for the WildBrain business, for which no acquisitions are currently under contract, and the risk factors discussed in materials filed with applicable securities regulatory authorities from time to time including matters discussed under “Risk Factors” in the Company’s Annual Information Form and annual Management Discussion and Analysis, which also form part of the Company’s annual report on Form 40-F filed with the United States Securities and Exchange Commission. These forward-looking statements are made as of the date hereof, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

For more information, please contact:

Investor Relations:

Nancy Chan-Palmateer – Director, Investor Relations, DHX Media Ltd.

nancy.chanpalmateer@dhxmedia.com

+1 416-977-7358

Media Relations:

Shaun Smith – Director, Corporate Communications, DHX Media Ltd.

shaun.smith@dhxmedia.com

+1 416-977-7230