Halifax, NS – 27 September 2017 – DHX Media Ltd. (or the “Company”) (TSX: DHX.A, DHX.B; NASDAQ: DHXM), a leading global children’s content and brands company, reports its fourth quarter and year-end results for the period ended June 30, 2017.

“Management was disappointed with the results for Q4 and Fiscal 2017 overall,” said Dana Landry, CEO of DHX Media. “Teletubbies in the U.S. market has underperformed, and execution on the content side of the business did not match the tremendous opportunity in the kids’ and family content market. On the positive strategic side, we capped off the fiscal year by closing our acquisition of Peanuts, a timeless brand that will accelerate our growth plans across the business. As part of the integration of Peanuts and Strawberry Shortcake into our business, we have taken corrective actions to address the issues that contributed to the disappointing financial results. We have realigned the management team to streamline production, restructure licensing activities and to focus on projects with the potential to drive multiple revenue streams. Furthermore, we recently initiated a cost-reduction program, and have reduced SG&A expenses by $3 million towards a target of $6 million within one year, incremental to our Peanuts synergies.”

Mr. Landry added, “We believe the market for content is extremely robust and growing, worldwide. Our restructured integrated platform will enable us to monetize our leading portfolio of kids’ and family content for a compelling value proposition as major streaming companies commit billions to grow their content budgets. Fiscal 2018 is off to a positive start with a multi-year royalty deal for Peanuts with Cedar Fair amusement parks. In addition to the SG&A reduction, integration on Peanuts is on track to achieve $5 million in targeted, first-year cost synergies. We have sharpened our focus with renewed energy for creating content and driving consumer products to generate free cash flow and EBITDA as the main measures of sustainable growth.”

1As a direct result of the adoption of the amendment to IAS 38 in Q1 2017, the Company’s definitions of Gross Margin and Adjusted EBITDA have been adjusted on a prospective basis. Gross Margin means revenue less direct production costs and expense of film and television programs produced (per the financial statements). Adjusted EBITDA represents income of the Company before amortization, finance income (expense), taxes, development expenses, impairments, share-based compensation expense, acquisition costs and adjustments for other identified charges. Adjusted Net Income adjusts net income (loss) for acquisition costs and certain identified charges, net of the tax affect. (The definitions of and changes to the definitions of Gross Margin, Adjusted EBITDA and Adjusted Net Income are included in the “Use of Non-GAAP Financial Measures” section of the Company’s Fiscal 2017 Management Discussion and Analysis).

Highlights included:

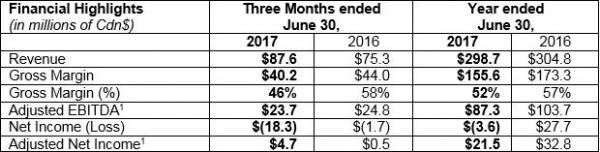

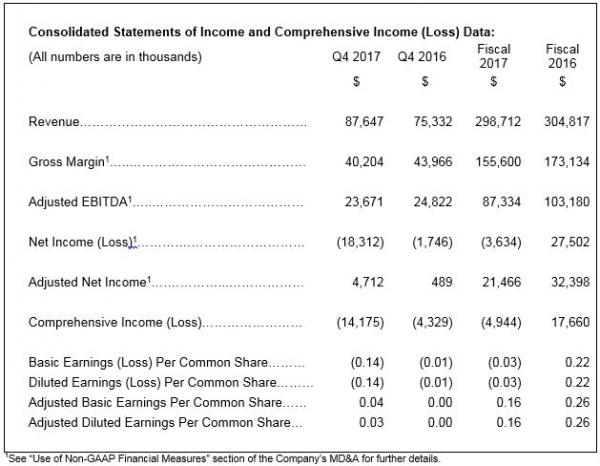

- Fiscal 2017 revenue of $298.7 million and adjusted EBITDA of $87.3 million was impacted by the rollout of the Teletubbies brand in the U.S., which didn’t gain the traction management expected, and the fact that the execution from the content business did not match the opportunity. Also, Fiscal 2016 was a tough prior-year comparative for the consumer-products represented unit. A net loss of $3.6 million was reported for the 2017 fiscal year. Year-end results also included $30.2 million of one-time acquisition and related refinancing costs associated with the Peanuts and Strawberry Shortcake

- WildBrain revenue grew 85% to $34.0 million in Fiscal 2017, reflective of increases in views across the network of 80% to 11 billion, and in watch times of 69% to more than 55 billion.

- Cash flow from adjusted operating activities for Q4 2017 was strong, at $11.8 million, as Management has increased its focus on cash.

- Content continues to be core to our business as we deliver on our strategic priorities of: (i) expanding our content library; (ii) distributing our shows globally; and (iii) developing global brands with strong consumer product potential.

Content Creation – In Fiscal 2017, 194 proprietary half-hours were added to the library, within our stated range for the year. At year-end, we had $37.3 million invested in proprietary projects in progress, aligned with our new content strategy. This will support future growth at a time when content budgets of leading on-demand services like Netflix and Amazon, along with newer entrants like YouTube, Apple and Facebook have grown to an estimated US$19 billion through 2018.

Content Distribution – Slippage of some content episode deliveries impacted distribution revenue in the short-term, but we continue to see favourable demand for both our original content and library titles, as the world’s leading media companies compete for customers, expand into new services and grow their global reach. During Fiscal 2017, we licensed our first show to YouTube Red, while Netflix picked up Season 2 of The Deep in the U.S. and global streaming rights for Fangbone! A 30-show volume deal was signed with Virgin TV in the UK and Ireland, marking their largest commitment to date for kids’ content. Amazon also licensed a range of catalogue titles for its Amazon Prime Video service in India.

Through our WildBrain network, we continued to monetize our library on YouTube as well as team up with third-party content-and-brand owners, including Turner, Moose Toys and American Greetings to reach kids on the platform, where they are increasingly consuming content and driving growing revenue from ad-based video-on-demand (AVOD).

Content-Driven Consumer Products – Teletubbies continued to be a top 5 pre-school property in the U.K., with the rollout of a broader product range underway. While Season 2 of the new series was picked up by Nick Jr., response to the toy program in the U.S. has been muted and we are reviewing our strategy for that market. Nevertheless, the new Teletubbies is now broadcast in over 24 territories around the world, and initial toy results are encouraging in key markets like Germany. In China, the new series has garnered almost 50 million views since launching in June 2017 on YouKu and iQIYI, two of the country’s largest streaming platforms. The Teletubbies toy rollout for China is gearing up, with toys expected in stores in early 2018.

Not only have we added Peanuts, a brand with truly global consumer reach, we are further diversifying our portfolio to drive consumer products potential with new content in production for Strawberry Shortcake, along with Mega Man, Bob the Builder, Fireman Sam and Little People through strategic partnerships.

Dividend Declaration

Today, the Company declared a dividend for the quarter of $0.02, an increase of 5%, on each common voting share and variable voting share outstanding to the shareholders of record at the close of business on October 13, 2017 to be paid on October 25, 2017.

Strategic Priorities, Course Corrections and Outlook

The Peanuts acquisition aligns completely with our strategic priorities by expanding our content library, creating opportunities for broader global distribution and significantly growing our consumer products business.

Since closing the acquisition on June 30, 2017, we have made considerable progress integrating the Peanuts and Strawberry Shortcake business, including refocusing our brands and licensing teams and clarifying roles in order to drive both cost and revenue synergies. These operational changes will allow us to leverage the scale, relationships and expertise from Peanuts across all our brand activities.

Initiatives to realize cost synergies following the Peanuts acquisition are well underway towards our target of $5 million for Year 1 and $25 million by Year 5. To date, we have realized synergies through the closing of our Los Angeles location and centralizing U.S. brands operations with Peanuts in a new New York office, as well as rationalizing duplicate functions and personnel company-wide. We have also identified six key territories to repatriate third-party agency fees by bringing duties in-house to CPLG. The first agency conversion is expected by the end of calendar 2017 with two more targeted for calendar 2018.

To better take advantage of the positive environment for kids’ and family content, Management is undertaking immediate course corrections to align forward execution with the tremendous opportunity in the global content market. Management is optimistic the following three course corrections will maximize shareholder value in Fiscal 2018, and beyond:

- Refocusing our Content Strategy and Group

- Restructuring our Brands and Licensing Group

- Resetting Corporate Priorities

Recently, we also initiated a cost reduction program targeting SG&A reductions of an incremental $6 million within one year, of which $3 million of costs have already been captured.

For additional information on course corrections undertaken by the Company, as well as details of management’s new outlook metrics for Fiscal 2018, including cash flow and adjusted EBITDA, please see the Outlook section of the Company’s Fiscal 2017 MD&A, available at www.dhxmedia.com, on www.sedar.com or http://www.sec.gov/edgar.

Analyst and Investor Webcast and Conference Call

DHX Media Management will hold a live webcast and presentation with slides for analysts and investors on September 28, 2017 at 8:00 a.m. ET, at the following address: https://edge.media-server.com/m6/p/xyosdpz8

To listen by phone, please call (844) 492-6042 toll-free, or (478) 219-0838 internationally and reference conference ID 89138824. Please allow 10 minutes to be connected to the conference call. The presentation for the call will also be posted to the Investor Relations section of our website, at: http://www.dhxmedia.com/investors/.

Consolidated Statements of Income and Comprehensive Income Data

Fiscal 2017 Results

Revenues

Revenues for Fiscal 2017 were $298.71 million, down 2%, or $6.10 million, from $304.81 million for Fiscal 2016. The decrease for Fiscal 2017 was due to a reduction in proprietary production revenues, accounting for $6.42 million of the decrease, a reduction in consumer products-represented revenues, accounting for $9.96 million of the decrease, a decrease in DHX Television revenues, accounting for $11.75 million of the decrease, a decrease in consumer products-owned revenues, representing $0.10 million of the decrease, and a decrease in digital revenues, accounting for $1.75 million of the decrease, offset by higher distribution revenues, representing $13.85 million of the offset, and an increase in producer and service fee revenues, accounting for $10.03 million of the offset. Comparatively, Fiscal 2017 and Fiscal 2016 materially include the same assets in terms of prior acquisitions, with the exception of the relatively immaterial acquisition of Kiddyzuzaa; accordingly, all revenue fluctuations are considered organic in nature. A detailed review of each source of revenue is included below.

Proprietary content revenues: The Company’s proprietary content revenue for Fiscal 2017 was up 4% to $163.54 million from $157.96 million for Fiscal 2016. Management was expecting growth in proprietary content revenue of 10% for Fiscal 2017 and growth at 4% was disappointing as the Company’s execution did not match the current opportunity of a very robust content environment. It is important to point out that the Company’s core strategic priority of investing in content generated increasing proprietary content revenues for Fiscal 2017, just not in keeping with Management’s expectations.

Proprietary production revenues: Proprietary production revenues for Fiscal 2017 were $36.88 million, a decrease of 15% compared to $43.30 million for Fiscal 2016. For Fiscal 2017, the Company added 194.0 proprietary half-hours to the library, down 10% from 215.0 half-hours for Fiscal 2016, but in-line with Management’s strategic goal of adding 150-225 proprietary half-hours annually to the library. For the Fiscal 2017, the Company also added 101.0 half-hours of third party produced titles with distribution rights (Fiscal 2016-150.0 half-hours). Third party produced titles with distribution rights are largely a result of the operational synergies associated with owning DHX Television and Management is pleased to report that the Company is now generating increasing distribution revenues from several of these third party produced titles with distribution rights, including, but not limited to, Backstage, Fangbone, Kuu Kuu Harajuku, and We Are Savvy.

Distribution and WildBrain revenues: Total distribution revenues were up 16% to $100.41 million, from $86.56 million for Fiscal 2016, driven by strong growth in WildBrain and continued strength in SVOD and linear television based distribution revenues. Management was expecting growth of approximately 21% for Fiscal 2017 and growth at 16%, although significant, fell short of the current opportunities in the distribution sales pipeline. The gross revenue from WildBrain for Fiscal 2017 was $34.03 million, up 85% versus Fiscal 2016 of $18.44 million, with the explosive growth in WildBrain being driven by strong monetization of DHX’s proprietary library, as well as an increasing contribution from third party content. For Fiscal 2017, the Company closed significant deals, among others previously announced, as follows: ITV, Lagardere Thematiques, Netflix, Turner Broadcasting Corporation, AMC Networks, iQiyi, Huashi, Shomax BV, Super RTL, VMe TV, Stan Entertainment, SpiritClips LLC, Viacom, and Virgin Media Ltd.

Consumer products-owned revenues (including live tour, music, and royalties): For Fiscal 2017, total consumer products-owned revenues were a disappointment for Management, materially unchanged for Fiscal 2017 at $24.90 million (Fiscal 2016-$25.00 million). Management expected growth in the range of 8-10% for Fiscal 2017 driven mainly by the anticipation that 2017 would be an inflection year for Teletubbies in the US for consumer products. This has not yet materialized due to a combination of the Company’s lack of execution in its marketing efforts in the territory, as well as competing interests among DHX partners in the US market. As a result, in Fiscal 2017 the Teletubbies have not yet gained sufficient traction to support a significant consumer products program in the territory in Fiscal 2017. Management is in the midst of devising a new plan for relaunch, likely focusing on a digital strategy. On the other hand, the launch of the Teletubbies in the UK is performing on or slightly ahead of Management expectations. Further, Management is encouraged by the early signs for the Teletubbies in both Germany and China. For 2018, Management expects continued favourable results for the UK, and progress to be be made in Germany and China. For Fiscal 2017, the Company recognized live tour revenues of $6.94 million associated with the combination of the 2016 Big Ticket Concert tour and the international portion of The Next Step Wild Rhythm Tour, versus $4.82 million in Fiscal 2016 for 2015 Big Ticket Concert tour and the domestic portion of The Next Step Wild Rhythm Tour. Excluding the live tour revenues, consumer products-owned revenues for Fiscal 2017 decreased $2.22 million or 11% from Fiscal 2016 driven largely by the timing of non-refundable minimum guarantees associated with Teletubbies and In The Night Garden, and the US initiative for Teletubbies being behind schedule.

Producer and service fee revenues: For Fiscal 2017, the Company earned $58.98 million for producer and service fee revenues, an increase of 20% versus the $48.95 million for Fiscal 2016 in range of Management’s expectations. Management is pleased with the continued robust demand for animated content and with the quality and profile of projects, including Where is Carmen Sandiego?, My Little Pony: The Movie, and several Mattel projects, currently being completed at our Vancouver and Halifax animation studios as we are seeing incremental opportunities to leverage our studio capacity across the rest of the DHX platform. Included in producer and service fee revenues for the Fiscal 2017 is $9.06 million in production revenue related to the Company’s strategic pact with Mattel, related mainly to production of Bob the Builder® and Little People®.

Digital revenues: For Fiscal 2017, digital revenues decreased 56% to $1.35 million (Fiscal 2016-$3.10 million), derived primarily from games and apps.

Television revenues: For Fiscal 2017, television revenues were $57.38 million compared to $69.13 million for Fiscal 2016, a decrease of 17%. Approximately 93% or $53.24 million (Fiscal 2016-$61.22 million) of the television revenues were subscriber revenues, while advertising, promotion, and digital revenues accounted for a combined 7% or $4.14 million (Fiscal 2016-$7.92 million) of DHX Television revenues. The decline in the subscriber revenues of 13% was generally in line with Management’s expectations and has been driven by the negotiated lower rates resulting from the Company’s strategic decision to focus the TV programming slate on our own proprietary content. All the material BDU’s have been locked in for the entirety of Fiscal 2018. The decline was further driven by a 48% decrease in advertising and promotion revenue well below Management’s expectations. Management is reviewing its plan for advertising on the channels including considering strategic partnerships to identify areas for growth in the category. Revenues were also approximately $1.80 million lower than expected as certain ancillary revenues, expected to be treated on a gross basis, were treated on a net basis.

Consumer products-represented revenues: For Fiscal 2017, consumer products-represented revenue was $18.81 million, down 35%, as was partially expected, compared to the Fiscal 2016 revenues of $28.77 million, due to a very tough comparative for Fiscal 2016, driven by a strong portfolio of represented brands including Despicable Me and Minions, Sesame Street, Dora the Explorer, The Pink Panther, and Jurassic World. Management expects to continue to build on its strong portfolio of represented brands and has recently added the BBC and Hatchimals in certain territories for Fiscal 2018 and beyond. At $18.81 million, consumer products-represented revenues were below Management’s expectations as a result of the steeper decline in revenues from Despicable Me and Minions than expected and a slower than expected ramp up of revenues on other portfolio brands. Management is optimistic about the future prospects for CPLG as it begins to execute on its operating leverage and its plan to convert third party agencies for Peanuts and Strawberry Shortcake in the coming years.

Gross Margin

Gross margin for Fiscal 2017 was $155.60 million, a decrease in absolute dollars of $17.72 million or 10% compared to $173.32 million for Fiscal 2016. The overall gross margin for Fiscal 2017 at 52% of revenue was below Management’s previously reported expectations. At 53%, the proprietary content gross margin was also below Management’s expectations, impacted by lower than expected live tour gross margins and increasing third party distribution revenues from both traditional distribution and from Wildbrain, which, while a positive reinforcement of DHX’s long-term content strategy, carry lower gross margins. At 26%, gross margins for producer and service fees were within Management’s annual expectations as the producer and service fee revenues earned pursuant to the Company’s strategic pact with Mattel, while carrying significant distribution and consumer products rights, also have lower gross margins. Gross margins for DHX Television, at 60%, were within Management’s expectations, impacted by both lower external content costs and lower than expected advertising revenues. Gross margin for Fiscal 2017 was calculated as revenues of $298.71 million, less direct production costs and expense of investment in film & television programs of $143.11 million and $nil expense of book value of acquired libraries, (Fiscal 2016-$304.82 million less $126.99 million and less $4.51 million, respectively).

For Fiscal 2017, the margins for each revenue category in absolute dollars and as a margin percentage were as follows: proprietary content business has a gross margin of $86.69 million or 53%, net producer and service fee revenue margin of $15.41 million or 26%, television margin was $34.69 million or 60%, and consumer products-represented revenue margin was $18.81 million or 100%.

Operating Expenses (Income)

SG&A

SG&A costs for Fiscal 2017 were down 2% at $74.13 million compared to $75.61 million for Fiscal 2016. During Fiscal 2017, Management’s continued to drive growth at WildBrain by adding resources, and began to reduce costs later in the year elsewhere in the organization. SG&A also includes $5.87 million in non-cash share-based compensation, down 2% (Fiscal 2016-$5.98 million). When adjusted, cash SG&A at $68.26 million, down 2% (Fiscal 2016-$69.63 million) was within Management’s most recently issued annual expectations.

Adjusted EBITDA

For Fiscal 2017, Adjusted EBITDA was $87.33 million, down $16.36 million or 16% over $103.69 million for Fiscal 2016. Please see the “Use of Non-GAAP Financial Measures” and “Reconciliation of Historical Results to Adjusted EBITDA” sections of the 2017 MD&A for the definition and detailed calculation of Adjusted EBITDA.

Q4 2016 Results

Revenues

Revenues for Q4 2017 were $87.65 million, up 16% from $75.33 million for Q4 2016. At $87.65 million, while below Management’s stated expectations, represents an all time high for quarterly revenues for the Company. For Q4 2017, revenues were lower than expectations for these key reasons: lack of execution and timing differences in the content business; lack of execution on licensing for the Teletubbies in the US, and lower than expected consumer products-represented revenues. In absolute dollars, the increase in Q4 2017 was due to continued strong growth in Wildbrain, seasonally high production service revenues, and growth in distribution revenues, offset by declines in DHX Television and consumer products-represented revenues. Comparatively, Q4 2017 and Q4 2016 include materially the same assets in terms of prior acquisitions with the exception of the relatively immaterial acquisition of Kiddyzuzaa; accordingly, all revenue fluctuations in comparing Q4 2017 to Q4 2016 are considered organic. A detailed review of each source of revenue is included below.

Proprietary content revenues: The Company’s proprietary content revenue for Q4 2017 was up 16% to $49.85 million from $42.91 million for Q4 2016. Management was expecting growth of approximately $13.00 million or 38% for Q4 2017 and growth of $6.94 million or 16%, although significant, fell short of Management’s expectations. This difference was driven by timing differences of content deliveries pushed into Fiscal 2018; certain shows abandoned based on course corrections on the go forward content strategy, specifically as Management did not proceed with two planned live action shows, instead choosing to focus on investing smaller amounts in a number of live action pilots, which are scheduled for delivery in early Fiscal 2018; and consumer products-owned underperforming for the Teletubbies in the US.

Proprietary production revenues: Proprietary production revenues for Q4 2017 were $6.03 million, a decrease of 6% compared to $6.39 million for Q4 2016. For Q4 2017, the Company added 54.0 proprietary half-hours to the library up 46% versus 37.0 proprietary half-hours for Q4 2016. For Q4 2017, the Company added 33.0 half-hours of third party produced titles with distribution rights (Q4 2016 – 30.0 half-hours), an increase of 10%. Third party produced titles with distribution rights are an example of the operational synergies associated with owning DHX Television, and a number of such titles yielded significant distribution revenues in Q4 2017.

Distribution and WildBrain revenues: For Q4 2017, total distribution revenues were $36.87 million, up 23% from $30.02 million for Q4 2016, driven by very strong growth in WildBrain. At $26.58 million for Q4 2017, distribution revenues excluding WildBrain were up $2.22 million or 9% from $24.36 million for Q4 2016. For Q4 2017, Management was expecting growth of approximately $5.85 million or 24% for distribution revenues excluding WildBrain and growth at 9%, although significant, fell short of the current opportunities in the distribution sales pipeline. A portion of the approximately $3.50 million shortfall were timing differences and are expected to occur in Fiscal 2018. Management, however, is very pleased with the current robust environment and the continued strong demand for content from competing SVOD and other new emerging platforms like YouTube, Apple, and Facebook. For Q4 2017, amongst other key distribution deals for both linear and digital platforms, the Company closed significant deals with Amazon Digital Services Inc, Google Ltd, Hunantv, Justbridge Entertainment, Sprout, Youku. Management is very pleased to report that revenues from WildBrain were $10.29 million for Q4 2017, reflecting 82% growth versus Q4 2016 revenues of $5.66 million, and generally in line with Management’s previously reported quarterly expectations.

Consumer products-owned revenues (formerly M&L-owned) (including music and royalties): For Q4 2017, the consumer products-owned revenues were $6.43 million, up 16% as compared to $5.52 million for Q4 2016. Management expected growth in the range of 50-55% for Q4 2017 driven by the anticipation that 2017 would be an inflection year for Teletubbies in the US for consumer products. This has not as of yet materialized due to a combination of the Company’s lack of execution in its marketing efforts in the territory as well as competing interests among DHX partners in the US market. As a result, the Teletubbies have not yet gained sufficient traction to support a significant consumer products program in the territory. Management is in the midst of devising a new plan for relaunch, likely focusing on a digital strategy. On the other hand, the launch of the Teletubbies in the UK is performing on or slightly ahead of Management expectations. Further, Management is encouraged by the early signs for the Teletubbies in both Germany and China. For Q4 2017, the Company recognized live tour revenues of $2.40 million versus $1.17 million for Q4 2016. Excluding the live tour revenues, consumer products-owned revenues were down 7%, driven mainly by timing differences for revenues from the Teletubbies, particularly in the US as noted herein, and other proprietary titles.

Producer and service fee revenues: For Q4 2017, the Company earned $21.50 million of producer and service fee revenues, an increase of 136% versus the $9.11 million from Q4 2016, and near Management’s previously reported quarterly expectations as progress on a number of key service projects began to accelerate during Q4 2017. Q4 2017 included significant production service revenues from its Mattel partnership properties, as well was revenues from Where is Carmen Sandiego? and My Little Pony: The Movie. See Gross Margin analysis below.

Digital revenues: For Q4 2017, digital revenues were down $0.45 million or 46% to $0.53 million (Q4 2016-$0.98 million) based primarily on apps and games.

Television revenues: For Q4 2017, DHX Television revenues were down 18% to $12.91 million from $15.80 million from Q4 2016, and were below Management’s quarterly expectations as promotion and advertising revenues were lower than expected and additionally, the Company recognized certain ancillary revenues, which it had expected to recognize on a gross basis, on a net basis, resulting in a $1.80 million reduction in revenues. The decline in the subscriber revenues was expected and has been driven by the negotiated lower rates resulting from the Company’s strategic decision to focus the majority of the TV slate on our own proprietary content. Management is reviewing its plan for advertising on the channels including considering strategic partnerships to create a pathway for growth. In Q4 2017, greater than 95% of the television revenues were subscriber revenues.

Consumer products-represented revenues (formerly M&L-represented): For Q4 2017, consumer products-represented revenues were down $4.13 million, or 55%, to $3.39 million compared to Q4 2016 at $7.52 million, and were below Management’s expectations as revenues from Despicable Me and Minions, which drove results in Q4 2016, have declined at a greater pace than anticipated and revenues from other portfolio properties thought to be able to make up for some of the decline have been slower than expected to materialize.

Gross Margin

Gross margin for Q4 2017 was $40.20 million, a decrease in absolute dollars of $3.77 million or 9% compared to $43.97 million for Q4 2016. The overall gross margin for Q4 2017 at 46% of revenue was below Management’s quarterly expectations. At 50% proprietary content margins were below Management’s previously reported quarterly expectations, driven by a number of factors: lower than expected consumer product-owned revenues, which carry high gross margins and higher than expected, live tour revenues which carry lower margins. Also impacting proprietary content margins were higher than expected third party distribution revenues for both traditional distribution and WildBrain (accounting for approximately $3 million in gross margin difference), which, while a positive reinforcement of the Company’s ability to leverage its platform, carry lower gross margins. Producer and service margins for Q4 2017 were lower than anticipated as Management utilized unused proprietary capacity and shifted it towards the Mattel partnership properties and during Q4 2017, which earned $2.50 million in revenues, the Company began two live action service projects to build new long-term relationships with upcoming content producers. These initiatives resulted in a gross margin shift and, at 20%, gross margins for producer and service fees were at the low-end of Management’s expectations. Gross margins for DHX Television, at 57%, were below Management’s expectations, impacted by both lower external content costs and lower revenues when compared to Q4 2016. Gross margin for Q4 2017, including DHX Television, was calculated as revenues of $87.65 million, less direct production costs and expense of investment in film & television programs of $47.44 million and $nil expense of book value of acquired libraries, (Q4 2016-$75.33 million less $30.40 million and less $0.97 million, respectively).

For Q4 2017, the margins for each revenue category in absolute dollars and as a margin percentage were as follows: the proprietary content business had a gross margin of $25.03 million or 50%, net producer and service fee revenue margin of $4.40 million or 20%, television margin was $7.39 million or 57%, and consumer products-represented revenue margin was $3.39 million or 100%.

SG&A

SG&A costs for Q4 2017 decreased 13% to $18.03 million compared to $20.69 million for Q4 2016. SG&A includes $1.50 million (Q4 2016-$1.55 million) in non-cash share-based compensation. When adjusted, cash SG&A at $16.53 million was at the mid-point of Management’s previously reported quarterly expectations, as Management has begun to reduce SG&A expenses across the Company, while still adding resources to drive WildBrain’s continued strong growth.

Adjusted EBITDA

For Q4 2017, Adjusted EBITDA was $23.67 million, down $1.15 million or 5% over $24.82 million for Q4 2016. Please see the “Use of Non-GAAP Financial Measures” and “Reconciliation of Historical Results to Adjusted EBITDA” sections of the 2017 MD&A for the definition and detailed calculation of Adjusted EBITDA.

About DHX Media

DHX Media Ltd. (TSX: DHX.A, DHX.B; NASDAQ: DHXM) is a leading children’s content and brands company, recognized globally for such high-profile properties as Peanuts, Teletubbies, Strawberry Shortcake, Caillou, Inspector Gadget, and the acclaimed Degrassi franchise. One of the world’s foremost producers of children’s shows, DHX Media owns the world’s largest independent library of children’s content, at 13,000 half-hours. It licenses its content to broadcasters and streaming services worldwide and generates royalties through its global consumer products program. Through its subsidiary, WildBrain, DHX Media operates one of the largest networks of children’s channels on YouTube. Headquartered in Canada, DHX Media has 20 offices worldwide. Visit us at www.dhxmedia.com.

Disclaimer

This press release contains “forward looking statements” under applicable securities laws with respect to DHX Media including, but not limited to, statements regarding the effect of the adoption of the amendment to IAS 38 on gross margins and Adjusted EBITDA of the Company, the integration of the acquisitions of Peanuts and Strawberry Shortcake and the expected financial and other impacts associated with such acquisitions, the timing of production schedules and deliveries, expectations regarding the growth and financial performance of WildBrain, expected benefits associated with the Company’s agreement with Mattel, the performance and growth of the Teletubbies brand, expectations regarding promotion and advertising revenues derived from DHX Media’s television channels, strategic priorities of the Company, the effect of course corrections made by management, the realization of synergies and other cost reductions, the markets and industries in which the Company operates, including demand for and consumption of kids’ content, the business strategies and operational activities of DHX Media and its subsidiaries, and the growth and financial and operating performance of DHX Media, its subsidiaries, and investments. Although the Company believes that the expectations reflected in such forward looking statements are reasonable, such statements involve risks and uncertainties and are based on information currently available to the Company. Actual results or events may differ materially from those expressed or implied by such forward looking statements. Factors that could cause actual results or events to differ materially from current expectations, among other things, include delivery and scheduling risk associated with production revenues, the Company’s ability to execute and close anticipated licensing transactions, the Company’s ability to close and effectively integrate the Peanuts and Strawberry Shortcake acquisitions, and the risk factors discussed in materials filed with applicable securities regulatory authorities from time to time including matters discussed under “Risk Factors” in the Company’s Annual Information Form and annual Management Discussion and Analysis, which also form part of the Company’s annual report on Form 40-F filed with the United States Securities and Exchange Commission. These forward-looking statements are made as of the date hereof, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

For more information, please contact:

Investor Relations: Nancy Chan-Palmateer – Director, Investor Relations, DHX Media Ltd.

nancy.chanpalmateer@dhxmedia.com

+1 416-977-7358

Financial Media: Shaun Smith – Director, Corporate Communications, DHX Media Ltd.

shaun.smith@dhxmedia.com

+1 416-977-7230