Halifax, NS – February 13, 2018 – DHX Media Ltd. (“DHX Media” or the “Company”) (TSX: DHX.A, DHX.B; NASDAQ: DHXM), a leading global children’s content and brands company, reported its second quarter and first six-month results for the period ended December 31, 2017.

“We delivered a second consecutive quarter of organic revenue growth in our core business, paired with strong cash flow from Peanuts,” said Dana Landry, CEO of DHX Media. “Our organic distribution revenue growth of 37% was led by WildBrain which grew organically by 73%, year-over-year and also from investments made in our partnership with Mattel.”

Mr. Landry continued, “We remain on track to achieve our targeted annualized savings from the Peanuts integration and company-wide cost-reduction program. Management remains focused on growing both revenues and cash flow, as we deliver on our commitment to de-lever.”

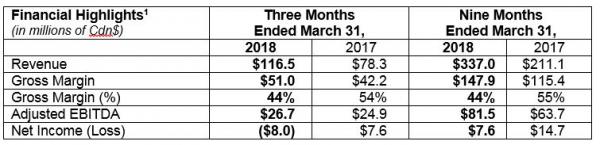

1Gross Margin means revenue less direct production costs and expense of film and television programs produced (per the financial statements). Adjusted EBITDA represents income of the Company before amortization, finance income (expense), taxes, development expenses, impairments, share-based compensation expense, and adjustments for other identified charges. The definitions of Gross Margin and Adjusted EBITDA are included in the “Use of Non-GAAP Financial Measures” section of the Company’s Q2 2018 Management Discussion and Analysis. Adjusted EBITDA and Net Income reflect only the portion attributable to DHX Media (excluding non-controlling interests).

Q2 2018 and H1 2018 Results Demonstrate Focus on Execution

Revenue for Q2 2018 grew by 55% to $121.9 million, compared to Q2 2017, which included 4% organic growth, and 51% acquisitive growth mainly from Peanuts and Strawberry Shortcake. For H1 2018, revenue rose by 66% to $220.6 million, of which 9% was organic. Organic revenue growth in the business highlights the returns being realized on our investment in content and the value of our library and brands.

For both Q2 and H1 of Fiscal 2018, gross margins were 44%, reflecting the new composition of our business with Peanuts and Strawberry Shortcake, as well as continued growth of third-party revenues from WildBrain and advancement of strategic brand partnerships.

For Q2 2018, adjusted EBITDA was as expected, at $32.0 million with net income reported at $7.4 million. In H1 2018, adjusted EBITDA was $54.8 million and net income at $15.6 million.

We remain on plan to achieve $11 million in targeted annual synergies on Peanuts and company-wide cost reductions by the end of Fiscal 2019, $5-$6 million of which is expected to be realized in Fiscal 2018.

Delivering on Our Content-Driven, Global Brand Strategy

Content continues to be core to our business as we deliver on our strategic priority to create compelling, new shows that distribute globally, and generate high-margin consumer products revenues.

Content Creation – Total production revenue in Q2 2018 was $26.6 million compared with $28.1 million from a year ago, in line with our focus on select properties that meet today’s demand for original content and brands. During the quarter, we added 52 new proprietary half-hours, generating $8.6 million in revenue, while service projects accounted for revenue of $18.0 million. The service pipeline continued to be strong, including ongoing production of new episodes under our Mattel partnership, which drive revenue participation across multiple licensing categories and generated $7.1 million in distribution revenue and consumer products royalties in Q2 2018.

At quarter-end, we had $32.6 million invested in productions in progress, which will feed future growth opportunities in distribution and consumer products.

Content Distribution – The global appetite for our original series and library titles continued to drive sales from the world’s top linear and on-demand providers. Following a successful premiere in the U.S., Nickelodeon has now extended season one of Massive Monster Mayhem to its channels in more than 140 territories. Cartoon Network has ordered a second season of Supernoobs for Europe, the Middle East, Africa and Asia Pacific. Tencent, a leading Internet company in China, picked up 450 half-hour of our kids’ content for its streaming services. This contributed to traditional distribution revenue rising by 28% to $16.6 million in Q2 2018 compared with a year ago, and 10% on an organic basis.

The scale of our WildBrain network and our expertise in managing kids’ brands on YouTube continued to drive increasing distribution revenue from the ad-based video-on-demand market. In Q2 2018, WildBrain’s revenue rose to $17.6 million, compared to $9.4 million in Q2 2017 and reflecting 73% organic growth. We are attracting a growing online audience to our network, currently at 35 million subscribers worldwide to date. In the first six-months of Fiscal 2018 alone, more than 55 billion minutes of videos were watched on WildBrain, derived from over 11 billion views – equal to the total watch times and views generated for the full 12-months of Fiscal 2017.

Content-Driven Consumer Products – Peanuts continued to perform well, providing a stable revenue stream and significant scale to our brands portfolio. Our consumer products business, including our in-house agency, CPLG, has grown to account for 38% of total revenue or $46.8 million in Q2 2018. Peanuts continued to build its brand, aligning with major partners including a new, global collection with Levi’s, Year of the Dog pop-up shops coming to Nordstrom in celebration of Snoopy and Chinese New Year as well as the latest Valentine-themed merchandising with Pottery Barn Kids and Teens.

The international rollout of Teletubbies also continued to advance with the first two licensees signed in China for toys and books. The Teletubbies brand has garnered more than 122 million views to date on China’s major streaming services, since its launch in June 2014.

Dividend Declaration

Today, the Company declared a dividend for the quarter of $0.02 on each common voting share and variable voting share outstanding to the shareholders of record at the close of business on February 23, 2018 to be paid on March 12, 2018.

Outlook

Management has reaffirmed its outlook metrics for Fiscal 2018, including cash flow and adjusted EBITDA, which are detailed in the Outlook section of the Company’s Q2 2018 MD&A, available at www.dhxmedia.com, on www.sedar.com or http://www.sec.gov/edgar.

Analyst and Investor Webcast and Conference Cal

DHX senior management will host a live webcast and conference call for investors and analysts at 8 a.m. ET on February 13, 2018, at the following address:

http://event.on24.com/wcc/r/1603007-1/FBA24413B18F3537FF2E23EFF26AAE07.

To listen by phone only, please call +1(888) 231-8191 or +1(647) 427-7450 internationally, and reference conference ID 8291937. Please allow 10 minutes to be connected to the conference call. The presentation for the call will also be posted to the Investor Relations section of our website, at: http://www.dhxmedia.com/investors/.

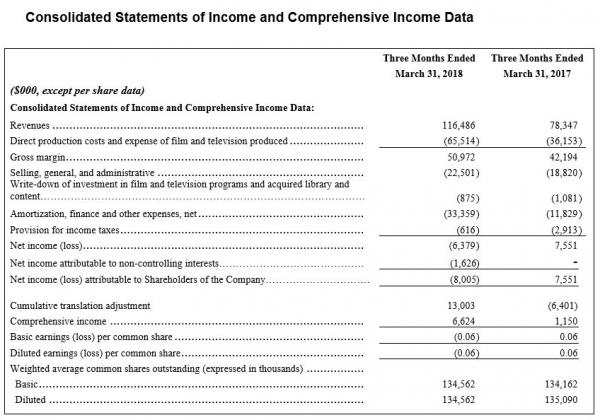

Revenues

Revenues for Q2 2018 were $121.94 million (68% organic, 32% acquisitive), up 55% from $78.87 million for Q2 2017. The increase for Q2 2018, was due to strong growth in total distribution revenue (including WildBrain) (89% organic, 11% acquisitive), accounting for 27% of the growth, higher consumer products-owned revenues (16% organic, 84% acquisitive), accounting for 80% of the growth, robust growth in producer and service fee revenues (all organic), accounting for 18% of the growth, offset by decrease proprietary production revenues (all organic), offsetting 21% of the growth, a decrease in consumer products represented revenues (all organic), offsetting 1% of the growth, and a decline in DHX Television revenue (all organic), offsetting 3% of the growth.

Proprietary production revenues: Proprietary production revenues for Q2 2018 were $8.64 million (all organic), a decrease of 51% compared to $17.68 million for Q2 2017. For Q2 2018, the Company added 52.0 proprietary half-hours to the library, down 2% versus 53.0 proprietary half-hours for Q2 2017. As noted in Q1 2018, the Company had expected to deliver 13 half-hour episodes of Supernoobs Season 2 during Q1 2018, but delivery was delayed; the Company is pleased to report that all of these episodes, and an additional 10 episodes of Supernoobs Season 2 were delivered in Q2 2018. For Q2 2018, the Company added 10.0 half-hours of third party produced titles with distribution rights (Q2 2017 – 23.0 half-hours), a decline of 57%. Third party produced titles with distribution rights are an example of the operational synergies associated with owning DHX Television; a number of such titles are now generating meaningful distribution revenues for the Company.

Distribution and WildBrain revenues: Management is pleased to report that for Q2 2018, total distribution revenues were $34.25 million (89% organic, 11% acquisitive), up 53% from $22.41 million for Q2 2017. Traditional distribution revenues (excluding WildBrain) for Q2 2018 were $16.61 million (86% organic, 14% acquisitive) compared to $12.97 million for Q2 2017, an increase of 28%, driven by the acquisitive revenue growth from Peanuts and organic revenue growth of 10%. Management is happy to report that revenues from WildBrain for Q2 2018 were $17.64 million (92% organic, 8% acquisitive), up 87% compared to $9.44 million for Q2 2017. The strong growth in both traditional distribution and WildBrain revenues is indicative of the continued strong global demand for content. For Q2 2018, amongst other key distribution deals for both linear and digital platforms, the Company closed significant deals with Disney, Viacom, Google, AB Svensk Filmindustries, France Television, and Rai Cinema.

Consumer products-owned revenues (including live tour revenue, music and digital royalties): For Q2 2018, the consumer products-owned revenues were $42.72 million (16% organic, 84% acquisitive), up 412% as compared to $8.34 million for Q2 2017. Excluding the acquisitive impact of Peanuts and SSC, consumer products-owned revenues were $6.75 million, down $1.59 million or 19% from $8.34 million in Q2 2017 , the decrease was driven entirely by the absence of lower margin live tour revenues in Q2 2018, compared to $3.90 million in live tour revenues for Q2 2017, and was offset by strong consumer products revenue royalties earned pursuant to the Company’s strategic pacts with Mattel, as noted in the Q2 2018 “Proprietary Content Revenues” section of the MD&A. Excluding acquisitive growth and live tour revenues, consumer product-owned revenues were $6.75 million compared to $4.44 million for Q2 2017, an increase of $2.31 million or 52%

Producer and service fee revenues: For Q2 2018, the Company earned $18.00 million (all organic) of producer and service fee revenues, an increase of 73% versus the $10.42 million from Q2 2017, as the Company continued to advance a number of key service projects. As discussed in the Six Months 2018 section of this MD&A, included in producer and service fee revenues are revenues of $3.09 million related to the Company’s strategic pacts with Mattel which, while carrying lower production service gross margins, are now generating significant distribution and consumer products revenues. The strong growth in producer and service fee revenues is a reflection of both the continued robust global demand for animated content and the quality and production being delivered by both our Vancouver and Halifax animation studios.

Television revenues: For Q2 2018, DHX Television revenues were down 8% to $14.24 million (all organic) from $15.39 million from Q2 2017. At $12.85 million for Q2 2018, subscriber revenues were down 5% from $13.53 million from Q2 2017, a combination of lower total subscribers and slightly lower average subscriber rates, consistent with Management’s expectations. Management is reviewing its plan for advertising on the channels, including considering strategic partnerships to create a pathway for growth. In Q2 2018, 90% of the television revenues were subscriber revenues.

Consumer products-represented revenues: For Q2 2018, consumer products-represented revenues were down $0.54 million, or 12%, to $4.10 million (all organic) compared to Q2 2017 at $4.64 million, as revenues from Despicable Me and Minions, which had a slightly positive impact Q2 2017, have now fallen off. When considering the expected declines from Despicable Me and Minions, Management was generally pleased with the performance of its portfolio of represented brands, including Sesame Street, Dora the Explorer, and Hatchimals in certain territories.

Gross Margin

The Company groups proprietary production, distribution (including WildBrain), and consumer products-owned into a single Proprietary Content Gross Margin for the purpose of providing analysis of gross margins.

Gross margin for Q2 2018 was $53.95 million, an increase in absolute dollars of $11.93 million or 28% compared to $42.02 million for Q2 2017. As expected, overall percentage gross margin was down for Q2 2018 at 44% of revenue compared to 53% of revenue for Q2 2017 as the acquisition of Peanuts and SSC has altered the composition of the Company’s gross margin. At 44% for Q2 2018, proprietary content gross margins as a percentage of revenue were down from 49% in Q2 2017, primarily a result of: i) the impact of the acquisition of Peanuts and SSC, which carries a lower percentage gross margin as the result of a revenue based talent fee payable to the estate of Charles M. Schulz, and ii) the continued strong growth of third party revenues in WildBrain, which carry a lower percentage gross margin. Producer and service margins for Q2 2018 were 18%, compared to 40% for Q2 2017, as Management continued to direct studio capacity towards its Mattel partnership projects, which while having lower percentage gross margins, carry with them the previously discussed distribution and consumer products rights. At 61%, gross margins for DHX Television, were largely consistent with Q2 2017 gross margins at 61% as Management has continued to utilize its large, diverse library. Gross margin for Q2 2018, was calculated as revenues of $121.94 million, less direct production costs and expense of investment in film & television programs of $68.00 million (Q2 2017-$78.88 million less $36.87 million).

For Q2 2018, the margins for each revenue category in absolute dollars and as a margin percentage were as follows: the proprietary content business had a gross margin of $37.90 million or 44%, net producer and service fee revenue margin of $3.16 million or 18%, television margin was $8.74 million or 61%, and consumer products-represented revenue margin was $4.15 million or 100%.

Operating Expenses (Income)

SG&A

SG&A costs for Q2 2018 increased 5% to $20.72 million compared to $19.64 million for Q2 2017. SG&A includes $1.02 million (Q2 2017-$1.60 million) in non-cash share-based compensation. When adjusted, cash SG&A at $19.70 million increased 9% as compared to $18.04 million for Q2 2017, a result of the additional SG&A related to the acquisition of Peanuts and SSC, offset by the impact of Management’s previously announced cost reduction initiatives. Management expects quarterly cash SG&A to decline throughout Fiscal 2018, while still continuing to drive growth in WildBrain and ensuring a smooth integration of Peanuts and SSC.

Adjusted EBITDA Attributable to DHX Media

For Q2 2018, Adjusted EBITDA attributable to DHX Media was $32.01 million, up $8.03 million or 34% over $23.98 million for Q2 2017. Please see the “Use of Non-GAAP Financial Measures” and “Reconciliation of Historical Results to Adjusted EBITDA” sections of this MD&A for the definition and detailed calculation of Adjusted EBITDA.

About DHX Media

DHX Media Ltd. (TSX: DHX.A, DHX.B; NASDAQ: DHXM) is a leading children’s content and brands company, recognized globally for such high-profile properties as Peanuts, Teletubbies, Strawberry Shortcake, Caillou, Inspector Gadget, and the acclaimed Degrassi franchise. One of the world’s foremost producers of children’s shows, DHX Media owns the world’s largest independent library of children’s content, at 13,000 half-hours. It licenses its content to broadcasters and streaming services worldwide and generates royalties through its global consumer products program. Through its subsidiary, WildBrain, DHX Media operates one of the largest networks of children’s channels on YouTube. Headquartered in Canada, DHX Media has 20 offices worldwide. Visit us at www.dhxmedia.com.

Disclaimer

This press release contains “forward looking statements” under applicable securities laws with respect to DHX Media including, but not limited to, statements regarding the integration of the acquisitions of Peanuts and Strawberry Shortcake and the expected financial and other impacts associated with such acquisitions, including synergies, cost reduction initiatives and the resulting financial and other impacts associated with such initiatives, the strategic priorities and operational focus of the Company, expectations regarding the impact of productions in progress on growth opportunities for the Company in its distribution and consumer products businesses, expectations regarding the growth and financial performance of WildBrain, expected benefits associated with the Company’s agreement with Mattel, the performance and growth of the Teletubbies brand, management’s review of strategic options for promotion and advertising on DHX Media’s television channels, the markets and industries in which the Company operates, the business strategies and operational activities of DHX Media and its subsidiaries, and the future growth and financial and operating performance of DHX Media, its subsidiaries, and investments, including annual growth and other financial targets. Although the Company believes that the expectations reflected in such forward looking statements are reasonable, such statements involve risks and uncertainties and are based on information currently available to the Company. Actual results or events may differ materially from those expressed or implied by such forward looking statements. Factors that could cause actual results or events to differ materially from current expectations, among other things, include delivery and scheduling risk associated with production and distribution revenues, the Company’s ability to execute and close anticipated licensing transactions, the Company’s ability to effectively integrate the Peanuts and Strawberry Shortcake acquisitions and realize synergies associated with such acquisitions, the Company’s ability to execute and realize on expected cost reduction initiatives, customer response to properties and brands of the Company and the risk factors discussed in materials filed with applicable securities regulatory authorities from time to time including matters discussed under “Risk Factors” in the Company’s most recent Annual Information Form and annual Management Discussion and Analysis, which also form part of the Company’s annual report on Form 40-F filed with the United States Securities and Exchange Commission. These forward-looking statements are made as of the date hereof, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

For more information, please contact:

Investor Relations: Nancy Chan-Palmateer – Director, Investor Relations, DHX Media Ltd.

nancy.chanpalmateer@dhxmedia.com

+1 416-977-7358

Financial Media: Shaun Smith – Director, Corporate Communications, DHX Media Ltd.

shaun.smith@dhxmedia.com

+1 416-977-7230